In 1995, Fuji Group (Hong Kong) Co., Ltd. was established (later renamed Fuji Group (Hong Kong) Industrial Holdings Co., Ltd.). It is mainly responsible for business in Asia and expanding overseas markets. The company's main business is elevators, automobiles, biotechnology, integrated circuit chips, Development and sales of smart products; petroleum, coal, non-ferrous metal trading, industrial investment, etc. The high-end manufacturing industry of elevators and automobiles is well-known worldwide. The company focuses on the four core areas of integrated circuit design, integrated circuit manufacturing, integrated circuit packaging and silicon materials, involving core products such as desktop CPUs, embedded CPUs, and storage, as well as lithography technology , Multi-chip packaging and other key technology production and research and development, research on IC technology 5nm and below common technology, etc., focusing on the construction of III-V high-end optoelectronic chips, silicon optical integrated chips, high-speed optical device testing and packaging products, mainly elevators In the fields of, automobiles, and mobile phones, Fuji inverters are widely used in elevators and automobiles. Most elevator manufacturers will use elevator parts made by Fuji; bio-fertilizer technology uses bio-engineering technology, continuous fermentation technology, rare-earth element application technology, and efficiency Technology, modified conditioning technology, soil testing formula technology, soil conditioning technology, plant conditioning technology, strength auxiliary materials, room temperature drying, one-time molding and other technologies, manufactured by a unique process, containing a variety of nutrients necessary for crops Elements, compound fertilizers are multi-component, multi-functional and efficient development directions, which play a role in balanced fertilization. The company’s petroleum trade mainly cooperates with crude oil from Russian petroleum products and other countries, and mainly sells D2, USLD, EN590 diesel (National V and National VI standards), JP54 aviation fuel, liquefied natural gas (LNG), liquefied petroleum gas (LPG) and crude oil. There are also overseas market customers in coal, non-ferrous metals, etc. In terms of industrial investment, we have invested in automobile, elevator, motor factories in Shanghai, Xinjiang, Liaoning, Anhui, Xinjiang rose essential oil, bio-fertilizer factories and oil refineries, and established oil exploration and pipelines with Kazakhstan For transportation and other matters, the Xinjiang oil refinery is planned to have a scale of 10 million tons per year. Many of its subsidiaries are engaged in the restoration of ancient buildings and temples, jewellery and jade rough stones, and investment in hotels and docks.

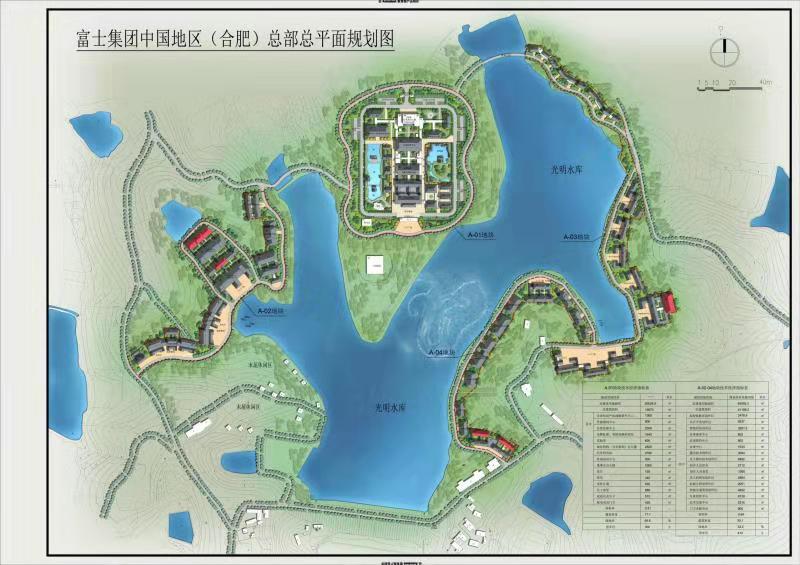

Currently, companies in mainland China include Fuji Group (Xinjiang) Investment Holding Co., Ltd., Fuji Elevator (Anhui) Co., Ltd., Fuji Automobile (Anhui) Co., Ltd., Fuji Electric (Anhui) Co., Ltd., and Fuji Group International Oil Trading Co., Ltd., etc. In 2018, Fuji Group's elevator operating income was about 2.6 billion yuan, bio-fertilizer was about 400 million yuan, the Fuji inverter industry was about 600 million yuan, and the chip design industry was about 2 billion yuan.

Fuji Semiconductor Discrete Devices (DOS), 2017 was 18.905 billion US dollars, a year-on-year increase of 10.1%, accounting for 16.8% of the total global semiconductor market value, mainly due to the promotion of power devices and other promotion of discrete device (DS) market sales increased by 10.7 year-on-year % And MEMS, radio frequency devices, automotive electronics, AI, etc. promote the sales of Sensors market (Sensors) increased by 15.9% year-on-year. The average selling price (ASP) of Fuji Wafer in 2017 increased by 68% year-on-year, and the total sales value reached US$8 billion, an increase of 74% year-on-year; the average selling price (ASP) of packaging and testing in 2017 increased by 38% year-on-year, and the total sales amounted to US$4.5 billion , A year-on-year increase of 44%, IGBT chips were 6.5 billion US dollars. Excluding the 13% increase in memory prices, the year-on-year growth rate of the Fuji Semiconductor market in 2017 was only 9%. Relying on the excellent performance of silicon wafers and IGBTs, Fuji Semiconductor has the record of ranking the third place in semiconductors in 2017.

In 2018, the Fuji Group Trading Company traded more than 8.5 billion euros in crude oil, natural gas, coal and other fossil energy, non-ferrous metals, etc.

富士电机(安徽)有限公司

Fuji Motor (Anhui) Co., Ltd

集团地址 / Add: 香港九龙花园道2-16号豪景大厦29楼2902室 / Room 2902, 29 / F, grand view building, 2-16 Garden Road, Kowloon, Hong Kong